Forums » Introduce Yourself

How to Become a Credit Card Payment Processor ?

-

How to Become a Credit Card Payment Processor

In today's digital era, where cash transactions are increasingly becoming a thing of the past, credit card processing has become the backbone of modern commerce. If you're interested in becoming a card payment processor and entering this dynamic industry, you're in the right place. In this article, we'll guide you through the steps to embark on your journey to becoming a credit card payment processor.

Understanding Credit Card Processing

Before we delve into the steps, let's clarify what credit card processing entails:

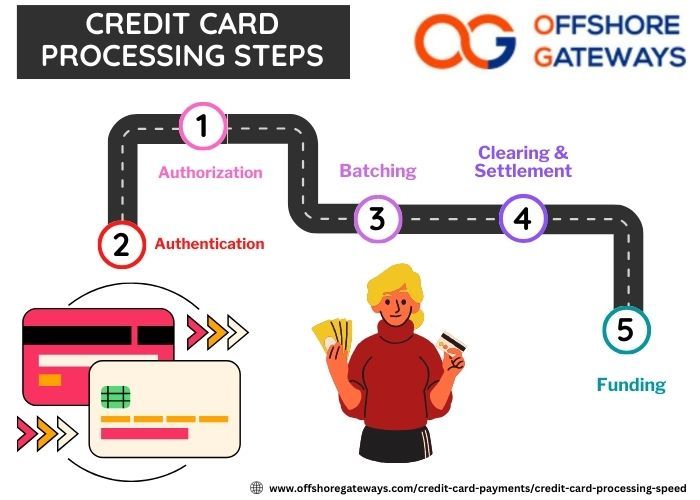

Credit Card Process: Credit card processing refers to the intricate series of steps involved in a financial transaction when a customer uses their credit card to make a purchase. It involves verification, authorization, and settlement to ensure secure and seamless fund transfer from the customer's account to the merchant's account.

Credit Card Processing: Credit card processing is the broader industry that encompasses all activities related to handling credit card transactions. This includes not only the processing itself but also the technology, regulations, and networks that make it possible.

Now, let's explore how you can become a part of this dynamic industry:

Steps to Become a Card Payment Processor

1. Gain Industry Knowledge: Start by acquiring a deep understanding of the credit card processing industry. Familiarize yourself with the various players involved, including merchants, payment card networks (like Visa and Mastercard), issuing banks, acquiring banks, and payment processors.

2. Education and Training: Consider formal education or training programs related to finance, banking, or payment processing. Many universities and online courses offer programs that can provide you with a solid foundation in this field.

3. Regulatory Compliance: Understand the legal and regulatory requirements for operating as a payment processor. Compliance with industry standards, such as PCI DSS (Payment Card Industry Data Security Standard), is essential to ensure data security and trustworthiness.

4. Business Setup: Establish a legal entity for your payment processing business. This might involve registering a company, obtaining necessary licenses, and adhering to financial regulations.

5. Build Industry Connections: Network with industry professionals, attend conferences, and join relevant associations. Building connections can provide insights, mentorship, and potential partnerships as you navigate your career in payment processing.

6. Technology Infrastructure: Invest in the necessary technology infrastructure to process credit card transactions securely and efficiently. This includes setting up a payment gateway and complying with data security standards.

7. Partner with Banks: To operate as a payment processor, you'll need to partner with acquiring banks. These banks facilitate transactions between merchants and credit card networks. Establish strong relationships with these banks to gain access to their services.

8. Obtain Necessary Certifications: Depending on your location and the services you plan to offer, you may need specific certifications. Research the requirements in your jurisdiction and ensure compliance.

9. Develop Pricing Models: Create competitive pricing models for your services. Determine how you'll charge merchants for processing their credit card transactions, whether it's through flat fees, percentage-based fees, or a combination.

10. Marketing and Sales: Market your payment processing services to potential clients, such as e-commerce businesses, retail stores, and online service providers. Effective sales and marketing strategies are crucial for attracting merchants.

11. Provide Excellent Customer Support: Offer exceptional customer support to your clients. Responsive and reliable customer service can set you apart in a competitive market.

12. Stay Informed and Adapt: The payment processing industry is constantly evolving, with new technologies and regulations emerging. Stay informed about industry trends and adapt to changes to remain competitive and compliant.

Becoming a credit card payment processor is a rewarding journey that requires dedication, industry knowledge, and a commitment to providing secure and efficient payment solutions. By following these steps and continuously learning and adapting, you can embark on a successful career in the world of credit card processing. Whether you aim to provide services domestically or explore the realm of offshore credit card processing, the opportunities are vast in this ever-growing industry.

#Howcreditcardprocessingworks

#offshorepaymentprocessing

#Creditcardprocessingforiptv

#Creditcardprocessingsteps

#Creditcardprocess

#Credidcardprocessing

#offshorecreditcardprocessor

#Merchantaccountforcreditcardprocessing

#processofcreditcardapplication

#Whatisanexampleofapaymentprocessor?

#HowdoIbecomeacardpaymentprocessor?

#Paymentandcardprocessingsolutions

#Whatiscreditcardprocessingsystem?

#Whatisacreditcardprocessor?