Forums » Off-Topic Discussions

The Best Way to Learn Forex Trading

-

If you've looked into trading foreign exchange (forex) online and feel it could be an opportunity to make money, you may wonder about the best way to get started.To get more news about forex education, you can visit wikifx.com official website.

It's important to have an understanding of the markets and methods for forex trading. That way, you can better manage your risk, make winning trades, and set yourself up for success in your new venture.

How to Get Educated About Forex

To trade effectively, it's critical to get a forex education. Spend some time reading up on how forex trading works, making forex trades, active forex trading times, and managing risk, for starters. There are plenty of websites, books, and other resources you can take advantage of to learn more about forex trading.

As you may learn over time, nothing beats experience, and if you want to learn forex trading, experience is the best teacher. When you first start out, you can open a forex demo account and try out some dry-run trading. It will give you a good technical foundation on the mechanics of making forex trades, as well as help you get used to working with a specific trading platform.

It is very easy for traders to think the market will come back around in their favor when they make a trading mistake. You might be surprised how many traders fall prey to this trap, and they are often upset when the market only presses further against the direction of their original trade.Think about this famous—and painfully true—statement from John Maynard Keynes about investing: "The market can stay irrational, longer than you can stay solvent." In other words, it does little good to say the market is acting irrationally and that it will come around—meaning in the direction of your trade. That's because extreme moves define capital markets in the first place.

Use a Micro Forex Account

The downfall of learning forex trading with a demo account alone is that you don't get to experience what it's like to have your hard-earned money on the line. Trading instructors often recommend that you open a micro forex trading account, or an account with a variable-trade-size broker, that will allow you to make small trades.Trading small will allow you to put some money on the line, but it will also allow you to expose yourself to very small losses if you make mistakes or enter into losing trades. This will teach you far more than anything that you can read on a site, book, or forex trading forum, and it gives an entirely new angle to anything that you'll learn while trading on a demo account.

Learn About the Currencies You Trade

To get started, you'll also need to understand what you're trading. New traders tend to jump in and start trading anything that looks like it moves. They may use high leverage and trade randomly in both directions, and this can often lead to the loss of money.Understanding the currencies that you buy and sell can have a big impact on your success.1 For example, a currency may be bouncing upward after a large fall. This may cause new traders to try to "catch the bottom."

The currency itself may have been falling due to bad employment reports for many months in its country. Would you buy something like that? Probably not. This is an example of why you need to know and understand what you buy and sell.

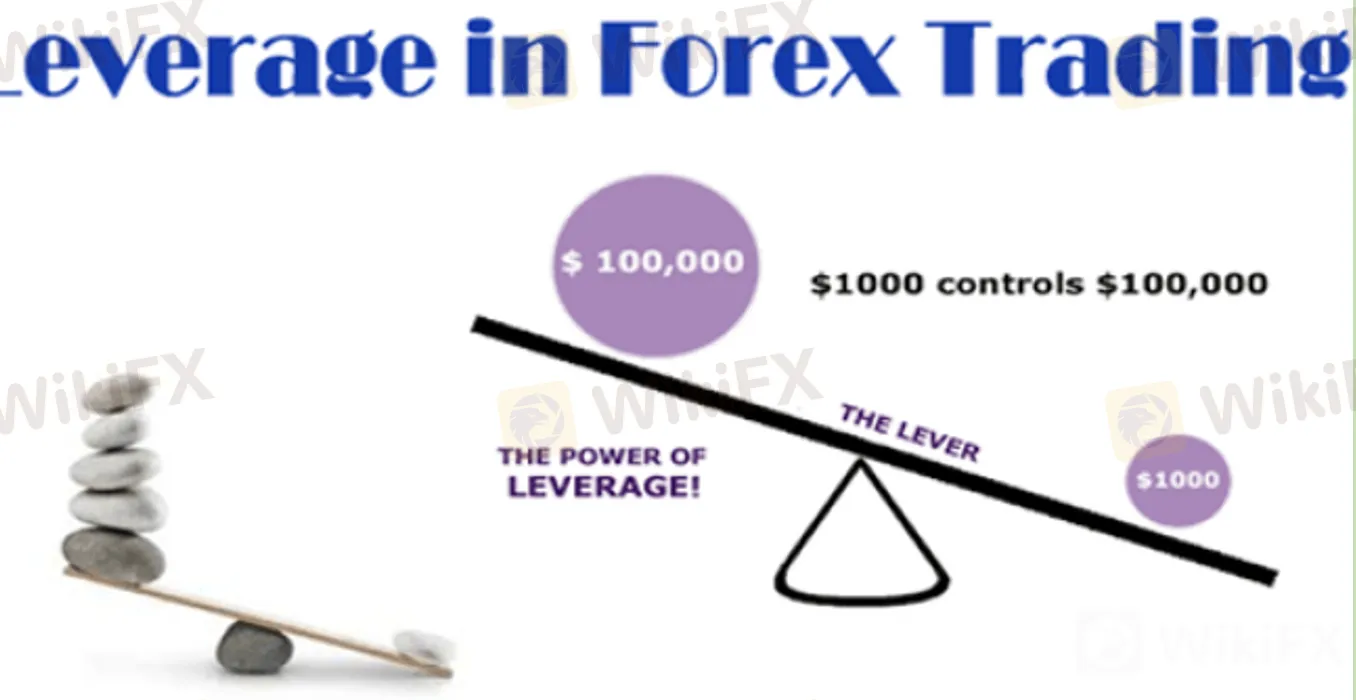

Currency trading is great because you can use leverage, and there are so many different currency pairs to trade.2 But this doesn't mean that you need to trade them all.

Manage Risk and Emotions

Managing risk and managing your emotions go hand in hand. When people feel greedy, fearful, or another emotion, this may be when they're more likely to make mistakes with risk. And this is what often causes failure.When you look at a trading chart, approach it with a logical mindset that only sees the presence or lack of potential for success. It should never be a matter of excitement.