Forums » Off-Topic Discussions

introducing-progressive-cavity-pumps

-

introducing-progressive-cavity-pumps

Bringing cutting edge pumping technology to the Mexican market has been a priority for Gustavo Pastrana Ángeles, Director General of SITEPP. The company partnered with Seepex, a German manufacturer of progressive cavity pumps, to introduce them to the Mexican oil market.To get more news about Progressive cavity pump stator, you can visit brysonpump.com official website.

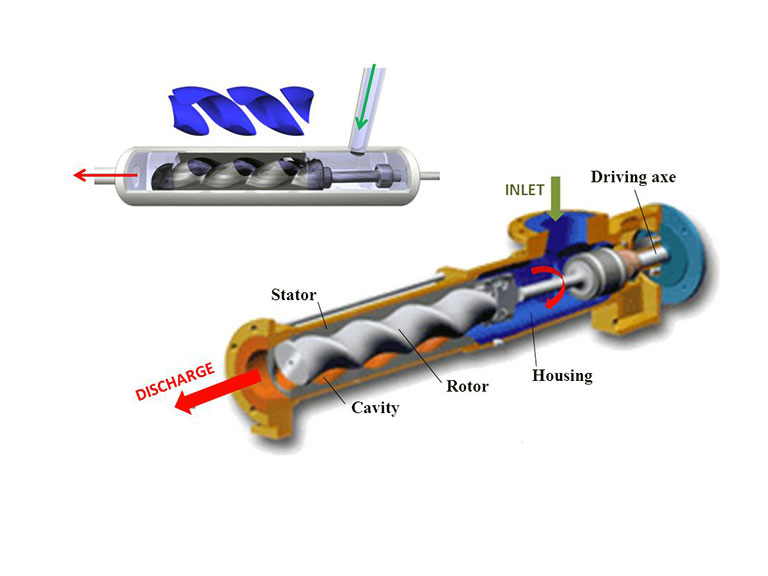

Progressive cavity pumps were initially created for the food industry. After developing their size and the construction materials, they were easily adapted to the oil industry’s needs. The pumps use positive displacement, generating exactly the amount of pressure needed in the well. This is managed through a pressure-monitoring computer that checks pressure and input/output through the pump, and makes adjustments accordingly. The pumps’ low shear is especially advantageous for the oil and gas industry because it ensures oil and water mixtures are not emulsified in the pump. The first Seepex pump was built in 1972 in Bottrop, Germany.

Aside from efficiency increases, the pump also boasts multi-phase handling that is able to pump water, oil, gas, and even solids with up to 5cm diameter. As such, progressive capacity pumps can be used for drilling waste management, to move drilling waste to cleaning equipment. A Seepex pump’s flow rate is proportional to rotational speed, which allows plant operators of centrifuge feed duties to perform flow estimations where flow meters would normally clog. As the pumps can be integrated directly into cuttings handling systems, thereby saving space, these solutions can be particularly useful at offshore installations, where space is restricted. Examples of integrated Seepex solutions include BTE range pumps with open hoppers and auger feed screws, located under shale shaker transport cuttings for feeding into a cuttings dryer, and BN/NS/N pumps to transport drilling mud from storage tanks into centrifuges.Additionally, the multi-phase handling in progressive cavity pumps reduces gas flaring. “Imagine that you have an oilfield that produces maybe 100 bbl/day and 7 Mcf of gas. With that amount of gas, you should not invest in a compressor; it’s not economically efficient. So usually, you would separate the oil and flare the gas,” Pastrana Ángeles says. “But with these pumps, you take the production to the next place, where other pipelines are arriving. So you have the volume to compress the gas and turn it into commercial gas.” The pumps are also fully self-priming, meaning no auxiliary devices are needed, and gas locking does not occur. In the oil and gas industry, applications for these pumps include the pumping of catalyst slurries, closed drain liquids, condensate, corrosion inhibitor, crude oil, drilling mud, produced water and refinery wastewater.

In an effort to introduce its technology into Mexico, SITEPP has run two field demonstrations for Pemex in order to prove the advantages of its pumps. The first field demonstration took place at KMZ on a platform where Schlumberger was supplying pumping equipment to Pemex. Onshore, SITEPP tested their pumping solution at Chicontepec’s Tierra Blanca field. Here, production was increased by 30%, and gas flaring was completely eliminated. The company’s aim at Chicontepec is to build a network of pumps that will be able to pool all of the company’s associated gas and transmit it to one receiving station, where the levels of gas collected would make processing a viable option for Pemex.

Pastrana Ángeles says SITEPP’s strategy has allowed it to capitalize on opportunities in Mexico despite the challenges of introducing automated solutions to Pemex. “We understand Pemex’s needs, and are constantly on the lookout for new technologies worldwide to meet them. The next step is seeking exclusivity of distribution rights in Mexico. One thing that is critical for success is which technologies we can realistically implement with Pemex. For example, the labour union often opposes the introduction of new automated technologies. However, we understand the best way to sell such products to the NOC, which values benefits for its workers, and technological assistance and training that aids comprehension and acceptance of such new technologies. As a result, integration of automated equipment does not go as quickly at Pemex as it does with other operators around the world, but despite this, it is still happening.”