Forums » Off-Topic Discussions

Xtrade Review

-

Xtrade Review

About Trust Score: Trust Score, a proprietary algorithm that allows traders to get an at-a-glance rating of a broker’s overall trust, was originally developed for BrokerNotes.co’s sister site, ForexBrokers.com. Trust Score is based on our independent research and is powered by the extensive data we’ve collected on brokers and regulatory agencies across a wide range of regulatory environments, jurisidictions, and countries.To get more news about xtrade review, you can visit wikifx.com official website.

Xtrade currently has 1 Tier-1 Licenses, 2 Tier-2 Licenses, and 1 Tier-3 Licenses. To get an idea of how Xtrade stacks up against the industry average, check out our visual breakdown of the average number of Tier-1, Tier-2, and Tier-3 regulatory licenses held by brokers in the BrokerNotes database:

Xtrade has a Trust Score of 80, compared to the industry average of 82, and BrokerNotes.co considers Xtrade to be Trusted. Trust Scores can vary from broker to broker (a "Highly Trusted" label means a broker is at the top of our scoring scale, and a "High Risk" label indicates a broker that's at the lowest end of our Trust Score scale), so it’s helpful to know where your broker stands in comparison to the rest of the industry.Check out our visual breakdown below to get an idea of how Xtrade’s status as a Trusted broker compares to the average Trust Score label in our database of 60+ forex brokers.

Why should I care about regulatory licenses?Determining the legitimacy of a forex broker (and avoiding forex scams) can be a real challenge. Unregulated brokers do not have to report to a governing body. If your broker lacks regulation, and you are scammed in any way, you often have no recourse for recovering your funds. That being said, not all regulator licenses carry the same weight.

There are now dozens of regulated forex brokers, each with their own product offering and range of available markets. It’s important to make sure that the forex broker you’ve chosen allows you to trade your preferred instruments and markets. To help you decide if Xtrade is the right broker for you, we’ve included a breakdown of the major products and range of markets available at Xtrade:Xtrade provides access to 142 tradeable symbols and 56 different forex pairs, compared to the median number of 982 symbols and average of 66 forex pairs across the 60+ brokers reviewed on BrokerNotes.

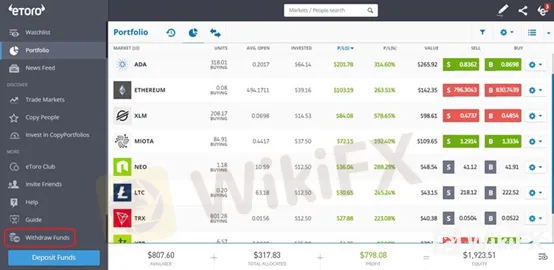

Tracked as variables within our database, our research team closely monitors the availability of features and products such as bitcoin, cryptocurrency CFDs, commodities, social copy trading, Islamic accounts, stocks (CFD and non-CFD), and some of the most popular forex pairs – among many others.

According to our independent database (currently tracking over 2,200 data points), the average forex broker offers 29 of the 37 products and features currently tracked for our offering of investments category. Xtrade offers 27, which helped contribute to the broker ranking #59 out of 62 brokers overall in this category.According to our independently researched database of international forex brokers, 100% of brokers offer forex trading (spot or CFDs), 6% offer crypto trading (physical asset), 87% offer trading physical cryptocurrency CFDs, 90% offer trading on U.S. stock CFDs, 29% offer trading on physical U.S. stocks, 52% offer ETFs, 34% offer international stock trading (non-CFDs), and 79% offer social copy trading.

The average minimum deposit requirement across the industry is £115 (55 brokers), whereas Xtrade requires an initial minimum deposit of $250. Forex brokers require a minimum deposit in order to cover their own costs associated with opening and maintaining a trading account for the client. The amount required can vary depending on the broker and the type of account being opened.