Categories

Tags

-

#ENT Devices Market

#Precision Medicine Market

#ENT Devices Market report

#ENT Devices industry

#Dental Radiography Market

#Dental Radiography Market report

#Dental Radiography industry

#NGS Sample Preparation Market

#NGS Sample Preparation Market report

#NGS Sample Preparation industry

#Precision Medicine Market report

#Precision Medicine industry

#Operating Room Integration Systems Market

#Operating Room Integration Systems Market report

#Operating Room Integration Systems industry

#Middle East Precision Medicine Market

#Middle East Precision Medicine Market report

#Middle East Precision Medicine industry

#Digital Biomarkers Market

#Digital Biomarkers Market report

#Digital Biomarkers industry

#Lung Cancer Genomic Testing Market

#Lung Cancer Genomic Testing Market report

#Lung Cancer Genomic Testing industry

#Precision Medicine Market size

#Precision Medicine Market research

#Precision Medicine Market value

#Precision Medicine Market share

#Precision Medicine Market drivers

#Capillary Electrophoresis Market

#Capillary Electrophoresis Market report

#Capillary Electrophoresis industry

#Capillary Electrophoresis size

#Gene Cloning Services Market

#Gene Cloning Services Market report

#Gene Cloning Services industry

#Gene Cloning Services Market size

#Gene Cloning Services Market value

#Gene Cloning Services Market research

#brain disease modalities and software market report

#brain disease modalities and software market

#brain disease modalities and software industry

#Middle East Liquid Biopsy Market

#Middle East Liquid Biopsy Market Report

#Middle East Liquid Biopsy Industry

#Middle East Liquid Biopsy Market size

#Middle East Liquid Biopsy Market value

#Aseptic Pharma Processing Market

#Aseptic Pharma Processing Market Report

#Aseptic Pharma Processing Industry

#Aseptic Processing Market

#Non-Invasive Prenatal Testing (NIPT) Market

#Non-Invasive Prenatal Testing (NIPT) Market report

#Non-Invasive Prenatal Testing (NIPT) Industry

#Non-Invasive Prenatal Testing (NIPT) Market size

#Viral and Non-Viral Vector Manufacturing Market

#Non-Viral Vector Manufacturing Market

#Viral and Non-Viral Vector Manufacturing Market Report

#Viral and Non-Viral Vector Manufacturing Industry

#Viral Vector Manufacturing Market

#Carrier Screening Market

#Carrier Screening Market Report

#Carrier Screening Industry

#Carrier Screening Market size

#Epigenetics Market

#Epigenetics Market Report

#Epigenetics Industry

#Epigenetics Market size

#Epigenetics Market Value

#Epigenetics Market Research

#Cancer Microbiome Sequencing Market

#Cancer Microbiome Sequencing Market Report

#Cancer Microbiome Sequencing industry

#Cancer Microbiome Sequencing Market size

#Cancer Microbiome Sequencing Market share

#Molecular Diagnostics Market

#Molecular Diagnostics Market Report

#Molecular Diagnostics industry

#Molecular Diagnostics Market size

#Molecular Diagnostics Market share

#Molecular Diagnostics Market trends

#Europe Hereditary Genetic Testing Market

#Europe Hereditary Genetic Testing Market Report

#Europe Hereditary Genetic Testing industry

#Europe Genetic Testing Market

#Europe Hereditary Genetic Testing Market size

#Organ Transplant Diagnostics Market

#Organ Transplant Diagnostics Market report

#Organ Transplant Diagnostics industry

#Organ Transplant Diagnostics Market size

#Organ Transplant Diagnostics Market value

#Organ Transplant Market

#Biomaterials Market

#Biomaterials Market report

#Biomaterials industry

#Biomaterials Market size

#Biomaterials Market value

#Biomaterials Market share

#Nucleic Acid Therapeutics CDMO Market

#Nucleic Acid Therapeutics CDMO Market report

#Nucleic Acid Therapeutics CDMO industry

#Liquid Biopsy Market

#Liquid Biopsy Market report

#Liquid Biopsy industry

#Liquid Biopsy Market size

#Liquid Biopsy Market value

#Liquid Biopsy Market research

#Liquid Biopsy Market share

#Liquid Biopsy Market analysis

#Liquid Biopsy Market growth

#Middle East Molecular Diagnostics Market

#Middle East Molecular Diagnostics Market report

#Middle East Molecular Diagnostics industry

#Middle East Molecular Diagnostics Market value

#Middle East Molecular Diagnostics Market growth

#Molecular Diagnostics Market research

#Single Cell RNA Sequencing Market

#Single Cell RNA Sequencing Market report

#Single Cell RNA Sequencing industry

#Single-cell Analysis Market

#Single Cell Sequencing Market

#OR Management Solutions Market

#OR Management Solutions Market report

#OR Management Solutions industry

#OR Management Solutions Market trends

#OR Management Solutions Market size

#OR Management Solutions industry value

#brain imaging modalities market report

#brain imaging modalities market

#brain imaging modalities industry

#brain imaging modalities market size

#Spine X-Ray and Computed Tomography (CT) Market

#Spine X-Ray and Computed Tomography (CT) Market report

#Spine X-Ray and Computed Tomography (CT) industry

#Next-Generation Gynecological Cancer Diagnostics Market

#Next-Generation Gynecological Cancer Diagnostics Market report

#Next-Generation Gynecological Cancer Diagnostics industry

#Next-Generation Gynecological Cancer Diagnostics Market Size

#MRD Testing Market

#MRD Testing Market report

#MRD Testing industry

#MRD Testing Market size

#MRD Testing Market value

#MRD Testing Market growth

#U.S. Solid Tumor Testing Market

#U.S. Solid Tumor Testing Market report

#U.S. Solid Tumor Testing industry

#U.S. Solid Tumor Testing Market size

#U.S. Solid Tumor Testing Market value

#U.S. Solid Tumor Testing Market growth

#U.S. Solid Tumor Testing Market research

#Minimally Invasive Surgical Systems Market

#Minimally Invasive Surgical Systems Market report

#Minimally Invasive Surgical Systems Industry

#Minimally Invasive Surgical Systems Market size

#Lung Cancer Genomic Testing Market size

#Lung Cancer Genomic Testing Market trends

#Precision Cardiology Market

#Precision Cardiology Market report

#Precision Cardiology industry

#Precision Cardiology Market size

#Precision Cardiology Market value

#Precision Cardiology Market growth

#Big Data in Healthcare Market

#Big Data in Healthcare Market report

#Big Data in Healthcare industry

#Big Data in Healthcare Market size

#Big Data in Healthcare Market value

#Big Data in Healthcare share

#Axial Spondyloarthritis Market

#Axial Spondyloarthritis Market report

#Axial Spondyloarthritis industry

#Axial Spondyloarthritis Market size

#axial spondyloarthritis treatment market

#Medical Grade Tubing Market

#Medical Grade Tubing Market report

#Medical Grade Tubing Industry

#Medical Grade Tubing Market size

#Medical Grade Tubing Market value

#Medical Grade Tubing Market growth

#Preimplantation Genetic Testing Market

#Preimplantation Genetic Testing Market report

#Preimplantation Genetic Testing industry

#Preimplantation Genetic Testing Market size

#Preimplantation Genetic Testing Market value

#Preimplantation Genetic Testing Market growth

#Pharmaceutical Quality Management Software Market

#Pharmaceutical Quality Management Software Market Report

#Pharmaceutical Quality Management Software industry

#Pharmaceutical Quality Management Software Market size

#Pharmaceutical Quality Management Software Market value

#mRNA Vaccines and Therapeutics Market

#mRNA Vaccines and Therapeutics Market report

#mRNA Vaccines and Therapeutics industry

#mRNA Vaccines and Therapeutics Market size

#Europe Infectious Disease Diagnostics Market

#Europe Infectious Disease Diagnostics Market report

#Europe Infectious Disease Diagnostics industry

#Europe Infectious Disease Diagnostics Market size

#Europe Infectious Disease Diagnostics Market growth

#NGS Oncology Market

#NGS Oncology Market report

#NGS Oncology Market industry

#Clinical Oncology Next Generation Sequencing Market

#Blood and Plasma Components Market

#Blood and Plasma Components Market Report

#Blood and Plasma Components industry

#Blood Components Market

#Blood and Plasma Components Market size

#Blood and Plasma Components Market share

#Pharmacogenomics Services Market

#Pharmacogenomics Services industry

#Pharmacogenomics Services Market report

Archives

MRD Testing Market Status and Outlook

-

Posted by BIS Reports - Filed in Business - #MRD Testing Market #MRD Testing Market report #MRD Testing industry #MRD Testing Market size #MRD Testing Market value #MRD Testing Market growth - 1,026 views

The global MRD testing market is in the rapidly evolving and dynamic stage, which opens ample opportunities for diagnostic and life science companies. Also, companies that are already in the development phase for MRD tests are trying to match themselves with modern technologies in the market to improve the overall system of MRD testing, from diagnostic assays and kits development to commercialization.

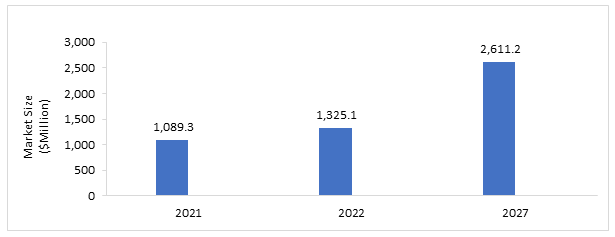

The minimal residual disease (MRD) testing market is projected to reach $2,611.2 million by 2027 from $1,089.3 million in 2021, at a CAGR of 14.53%. The market is driven by certain factors, such as the rising incidence of hematologic malignancies, increasing consumer awareness for tailored therapy, increasing research funding from the National Cancer Institute and increasing disposable income in emerging economies.

Impact

With an increased worldwide focus on treating hematological malignancies, the major market players are developing novel diagnostic tests, which are significantly impacting the growth of the MRD testing market. Diagnostic evolution in the form of companion diagnostics and liquid biopsy through molecular techniques such as PCR and NGS has enabled molecular diagnostic juggernauts to enter this market seamlessly. Following FDA approvals of clonoSEQ and Signatera, major companies are now looking to invest in the field of MRD, focusing primarily on the foundation laid for hematological malignancies. The market witnessed approximately 35 significant synergistic developments during the time period between January 2018 and May 2022.

Market Segmentation

Segmentation 1: by Technology

• Flow Cytometry

• Polymerase Chain Reaction (PCR)

• Next-Generation Sequencing (NGS)

• Other TechnologiesDue to recent developments in molecular diagnostic technologies, the turnaround time and overall cost have been reduced with increased sensitivity and accuracy of results. Significant advances are being witnessed in the development of highly sensitive, quantitative, and multiplex assays. Some of the new technologies include NGS and low-cost PCR devices available in the form of multiparameter assays and multiplexing devices for MRD testing.

Segmentation 2: by Application

• Hematological Malignancy

• Solid TumorThe global MRD testing market (by application) is broadly segmented into hematological malignancy and solid tumor applications. The global MRD testing market (by application) is dominated by hematological malignancy, which held a share of 94.39% in 2021.

Segmentation 3: by End User

• Hospital and Specialty Clinics

• Diagnostic Laboratories

• Research Institutions

• Other End UsersEnd users of the MRD market typically include hospitals and specialty clinics, research institutions, diagnostic laboratories, and others. Although hospitals and specialty clinics have been at the forefront of developing advanced technologies that incorporate several ancillaries for superior biological and chemical research, the applicability of MRD tests has been widespread among research institutions. Other end users, such as out-patient clinics and cancer clinics, also contribute significantly to the global MRD testing market.

Segmentation 4: by Region

• North America

o U.S.

o Canada

• Europe

o Germany

o Italy

o France

o U.K.

o Spain

o Rest-of-Europe

• Asia-Pacific

o China

o India

o Japan

o South Korea

o Australia

o Singapore

o Rest-of-APAC (RoAPAC)

• Latin America and Middle East

o Brazil

o Mexico

o Saudi Arabia

o Rest-of-Latin America and Middle East

• Rest-of-the-World (RoW)In 2021, North America accounted for a share of 42.92% of the global minimal residual disease testing market. The segment is expected to reach $1,016.8 million in 2027 from $467.5 million in 2021 at a CAGR of 12.68% during the forecast period 2022-2027.

Recent Developments in the Global MRD Testing Market

• In November 2021, Palmetto GBA’s Molecular Diagnostics Program (MolDX) confirmed a local coverage determination that supported the Medicare coverage for clonoSEQ in patients with B-cell acute lymphoblastic leukemia (ALL), multiple myeloma (MM), and chronic lymphocytic leukemia (CLL) for monitoring minimal residual disease.

• In February 2021, Natera, Inc. and Personalis, Inc. partnered in the field of personalized oncology by combining Personalis’ NeXT tumor profiling and diagnostic products with Natera’s personalized ctDNA platform Signatera for treatment monitoring and molecular residual disease assessment.

• In May 2021, Invivoscribe, Inc. announced licensing of key software and two new MRD clinical services. The company’s LymphoTrack Enterprise Software supported high volume customers to meet ever-increasing testing demands.

• In October 2021, Inivata Limited, a subsidiary of NeoGenomics, Inc. entered a clinical collaboration with the Princess Margaret Cancer Center in Toronto, Canada, for the use of Inivata's InVisionFirst-Lung and RaDaR liquid biopsy assays in two separate studies.Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Public companies include ICON plc, Bio-Rad Laboratories, Inc., Adaptive Biotechnologies Corporation, Sysmex Corporation, Quest Diagnostics Incorporated, Opko Health, Inc., NeoGenomics Laboratories, Inc., Natera, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche, and Guardant Health. The private company profiled are ARUP Laboratories, Cergentis B.V., Invivoscribe, Inc., and Mission Bio, Inc.

Get Free Sample Report - https://bisresearch.com/requestsample?id=1307type=downloadHow can this report add value to an organization?

Technology/Innovation Strategy: The technology segment helps the reader understand the different technology based on MRD testing present in the market. Moreover, the study provides the reader with a detailed understanding of two different applications including hematologic malignancy and solid tumor.

Growth/Marketing Strategy: The global MRD testing market has seen major development by key players operating in the market, such as synergistic activities, product approvals, product launches and updates, mergers and acquisitions, business expansion and funding, and other developments (Medicare coverage). The favored strategy for the companies has been regulatory and legal activities along with product approvals to strengthen their position in the market.

Competitive Strategy: Key players in the global MRD testing market have been analyzed and profiled in the study. Moreover, a detailed competitive benchmarking of players operating in the global MRD testing market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

BIS Related Reports

Global Tumor Genomics Market

Global Hematologic Malignancies Testing Market