Forums » Off-Topic Discussions

Doo Prime review – Is it safe to trade with this broker?

-

Doo Prime review – Is it safe to trade with this broker?

Doo Prime is definitely not a new kid on the block, judging from the fact that it’s a subsidiary of a rather large Group Holding in Hong Kong. However, despite it being a subsidiary, our Doo Prime review found out that the brokerage has some grey areas it wants to hide.To get more news about doo prime review, you can visit wikifx.com official website.

Doo Prime at a glance

When visiting the website, it’s not really difficult to be impressed with all the CSS and Javascript gimmicks of the brokerage. They decided to go with the “one page” website layout, which to be honest, is not as user-friendly as one may imagine. Having all the information segmented into their separate pages is a much better resource for better transparency.Speaking of transparency, the first aspect that raised the questions about the Doo Prime scam is the disclosure of the broker’s awards. It may seem that the company is quite honest with its operations by disclosing info about being a subsidiary, but when it comes to the rewards that it claims to possess, there is no evidence.

For example, Doo Prime claims that they’re the owner of the 2017 best MT5 broker award, which they don’t link to, and Google says that it’s actually the FxPro Forex broker and not Doo Prime.With all that being said, we don’t want to call someone a scam without further researching their platforms. Besides, transparency issues alone don’t strictly suggest that Doo Prime is a fraudster.

Doo Prime regulation and license

When digging through the footer of Doo Prime’s website, where legal information is usually located for Forex brokers, we found out that they are a subsidiary of Doo Holding Group Limited, located in Hong Kong. However, the Doo Prime Forex broker itself is in the Cayman Islands.But, the trick here is that they’re not licensed by the Monetary Authority of the Cayman Islands, they’re just registered there. This ultimately makes them an unlicensed offshore broker, which are hardly the words you want to hear when choosing a Forex brokerage firm.

Once again, this further diminishes the reputation of the Doo Prime Forex broker. However, it’s worth noting that we’ve seen many offshore brokers that follow strict financial guidelines, regardless of the absence of the government regulator.

In the next section, we’ll discuss how Doo Prime entices traders to register with them and whether its features are worth your time and effort.

Doo Prime trading conditions

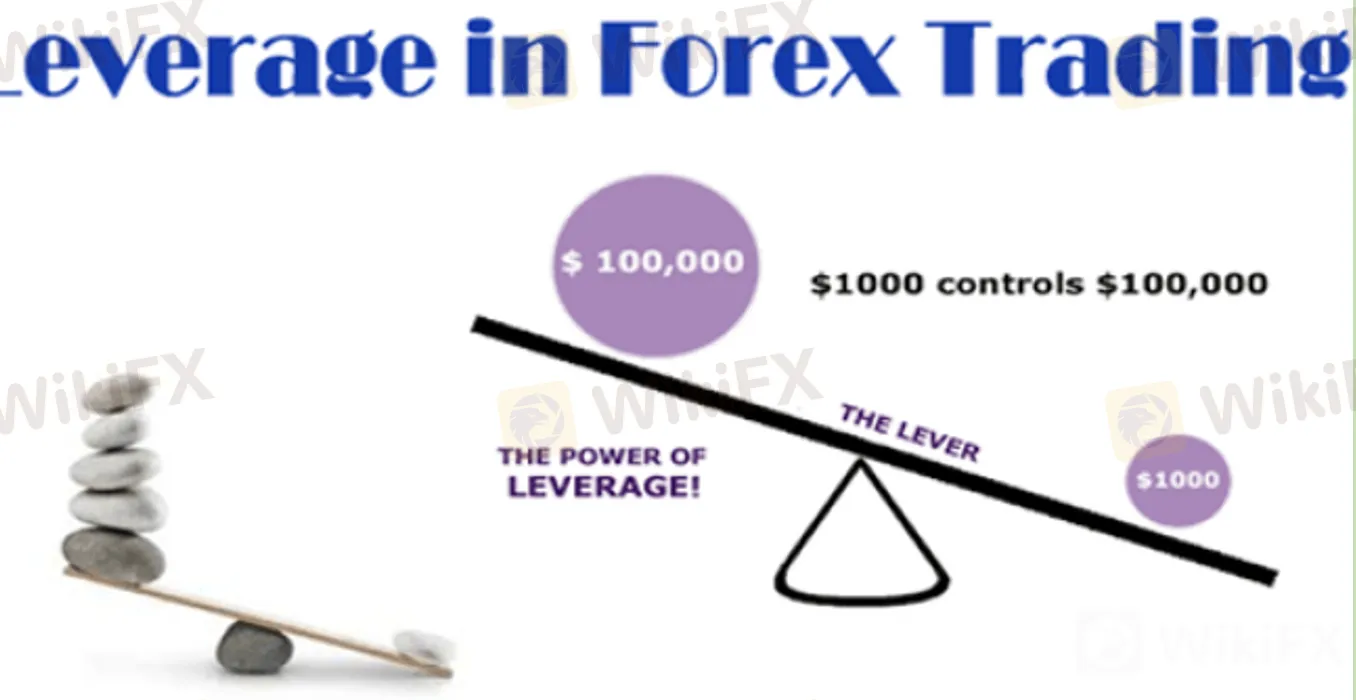

In terms of trading conditions, Doo Prime does not strike as an amazing deal. Being offshore and unlicensed should provide them with unlimited possibilities to market to their potential customers, but their real capabilities fall short compared to even the most strictly regulated companies in Europe.Doo Prime Forex broker promises leverage up to 1:400 on major currency pairs, alongside a spread that goes as low as 1 pip and a minimum deposit of $100 and $5000 on its two trading accounts respectively.Let’s start with leverage. As you may or may not already know, this feature is used to increase the initial trading funds substantially. For instance, with Doo Prime’s leverage rate, you can increase your trading capital by x400 times, which is just bonkers.

However, we need to point out that many reliable brokers tone this feature down quite a bit. In the US and EU, brokers are restricted to only 1:30 leverage for customer safety. So, can Doo Prime be trusted, considering its overzealous leverage offering? Well, we cannot say for sure that it’s a scam but it certainly raises some questions.

Moving on, let’s talk about the spreads. While the minimum spread of 1 pip is more or less decent, other brokers go as low as 0.1 or even 0.01 pips, which indicates that Doo Prime isn’t as competitive as its counterparts. Besides, the average spread markup is far higher than 1 pip – around 17 pips on most pairs.

We weren’t able to find any information about the methods that traders will have in terms of Doo Prime withdrawals and deposits, but judging by the fact that they promote a “partnership” between banks like the Bank of America and HSBC, it’s easy to believe that they use Wire transfer and credit cards the most.

Once again, we don’t know about the fees on these deposits or withdrawals, yet we can speculate that there will be some charges on the transactions you make, simply because Doo Prime doesn’t really strike us as a customer-oriented brokerage.